Elizabeth, 79, was ensnared by a romance scam that not only depleted her savings but also pushed her into borrowing money from friends and family.

Three years after the passing of her husband, Elizabeth Ferguson, a grandmother and retired senior university manager, decided to explore online dating. Instead, she fell victim to a heartless romance scam, resulting in a loss of almost a quarter of a million pounds.

Elizabeth met “Courtney Roy” almost immediately after joining Match. “His profile said he was 68 and his interest included nature, travelling and volunteering. His pictures showed a normal good-looking man” Elizabeth recalled.

Their relationship deepened over time. They discovered they lived near one other, and he shared that he had been through a divorce due to infidelity on his wife’s part. He also revealed he had a challenging childhood in Cyprus after losing both parents.

“This was part of the scam. Not just to gain my sympathy, but to explain errors in his written English.”

They made plans to meet up in person, and even attempted to video call one another. “It was near impossible to see or hear him, but it didn’t seem odd. Connections can be bad anywhere.”

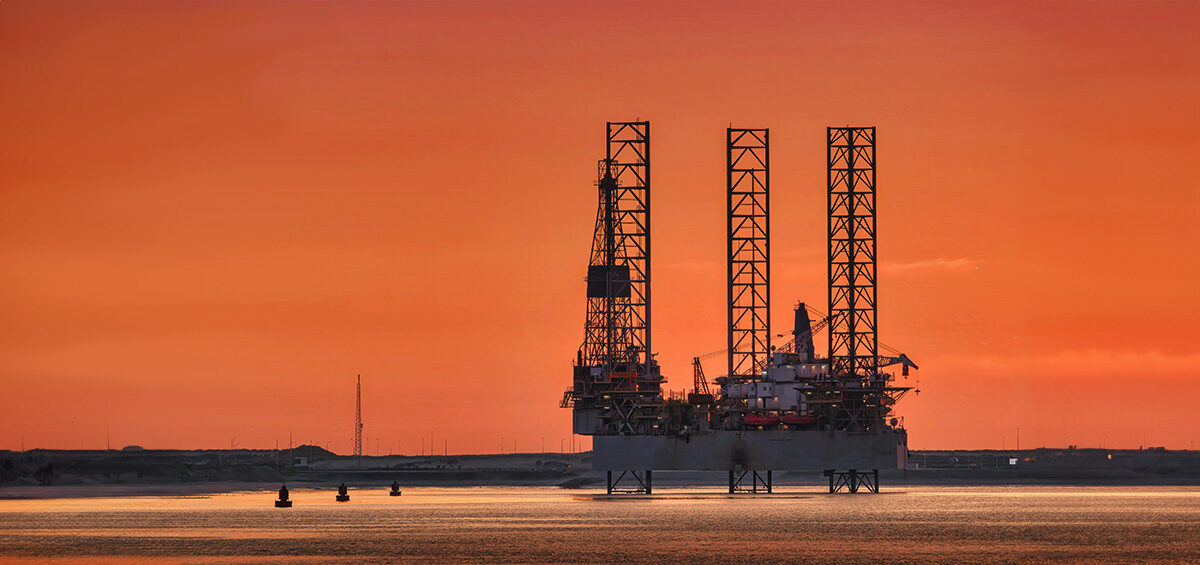

Called away to work on an oil rig

Just as they were due to meet in person, he claimed that he had been called away to an urgent job installing a 5G connection on a Japanese oil rig in the North Sea. Unbeknownst to Elizabeth; claiming to work on an oil rig, isolated and with poor signal is a common excuse of romance scammers.

A short time later, Courtney asked Elizabeth for a favour. He gave Elizabeth his bank details so that she could log in to his account and make the purchase. When she logged in, she found a balance of $1.45million in his account.

“The first step was a message that he needed $70,000 for some expensive equipment. He wasn’t asking me for money, just to log in to his bank account and make the transfer as his signal was terrible. It was a sign of his trust in me.”

Elizabeth made the purchase and was then asked to send a further $7,000. Compared to the $1.45million in his account and the $70,000 previously sent, this didn’t seem out of the ordinary or expensive. He could easily afford it.

Then the transfer failed.

Elizabeth recollects that he explained it was something to do with his IP address, and that he was now locked out of his account until he could return. He then asked Elizabeth to temporarily help cover the fee. She agreed and was told to send money via a crypto app.

Again, this is a red flag. Scammers often coerce their victims into using cryptocurrency.

Explosion on the oil rig

A short time later, Elizabeth received an alarming message claiming that there had been an explosion on the oil rig, and that Courney and his colleagues were in danger. He even sent a video of the incident happening. “I was so worried, so when he asked me to send more money, I was in such panic that I did. I used a crypto app that he told me to download.”

Soon after, a banker’s draft for almost € 1million arrived in Courtney’s name.

“He was hitting me with a combination of ‘I love you, I’m in danger, and here’s proof of all the money I have”.

To pay for the ever-escalating requests Elizabeth started borrowing money from friends and family, claiming it was for work needed for her house. “I stopped sleeping and eating. I lost a stone.”

“I’d already sent him so much. If I refused a request, maybe he wouldn’t come and activate the banker’s draft – then I’d lost it all.” Elizabeth was trapped. Whenever she brought up the money or questioned Courtney, he became verbally aggressive. “He accused me of being bipolar. He was manipulative.”

Recovering money after a romance scam

When both the police and Action Fraud were unable to help Elizabeth recover her money, she thought all hope was lost. Then a relative recommended CEL Solicitors.

We listened to Elizabeth’s case and found that her bank had failed to adequately protect her money. As a former university manager and successful businesswoman, without a history of sending vast sums of money to mysterious accounts, concerns should have been raised by her bank.

“I had no idea there’s an obligation on institutions like banks to protect customers, that a solicitor could hopefully get my money back.”

The fraud recovery team at CEL Solicitors were able to recover £252,000 for Elizabeth. Since then, she has contacted Match and had the fraudulent account taken down.

“I never want this to happen to anyone else. This man is still out there, he could be doing this to multiple women right now. Romance fraud really does destroy lives.”