Have you been the victim of a bank scam? Did the scammer impersonate your bank using phone spoofing software? If you’ve been contacted by the Metropolitan Police, then you’re not alone.

The police have text 70,000 people who were targeted by scammers using iSpoof, a phone spoofing website that has now been shut down.

The service, which enabled criminals to mimic bank telephone numbers and caller IDs, was used by scammers to trick victims out of thousands – and in some cases, millions – of pounds.

British police, who began investigating the site in June 2021, were part of a global operation to take down ispoof.cc – a website which they described as ‘an online fraud shop’.

Working with Dutch law enforcement, police tapped into the website’s servers in the Netherlands, enabling them to listen to phone calls.

Disturbingly, millions of people were targeted by scammers using iSpoof, which is said to have made the website over £3 million in profit.

However, that figure is dwarfed by the amount its users are believed to have netted after impersonating UK banks (a figure believed to be in the region of £48 million).

Commenting on the iSpoof scam, Paul Hampson, the owner and director of CEL Solicitors, said: “If you’ve received a text message from the police then it’s because scammers have targeted you, using iSpoof’s phone spoofing technology.

“For some, who lost money to scammers, this will be incredibly distressing. However, all is not lost. CEL Solicitors specialise in helping people who’ve lost money to scammers. So, if you’ve tried, but have been unsuccessful in getting your money back then we can help.”

What is iSpoof?

Recently shut down by police, iSpoof is a website offering phone spoofing technology to fraudsters. Scammers paid subscriptions to iSpoof, which enabled them to change their caller ID. They then used this to impersonate UK banks (more on Impersonation scams) and scam unsuspecting victims out of thousands, and in some cases, millions of pounds.

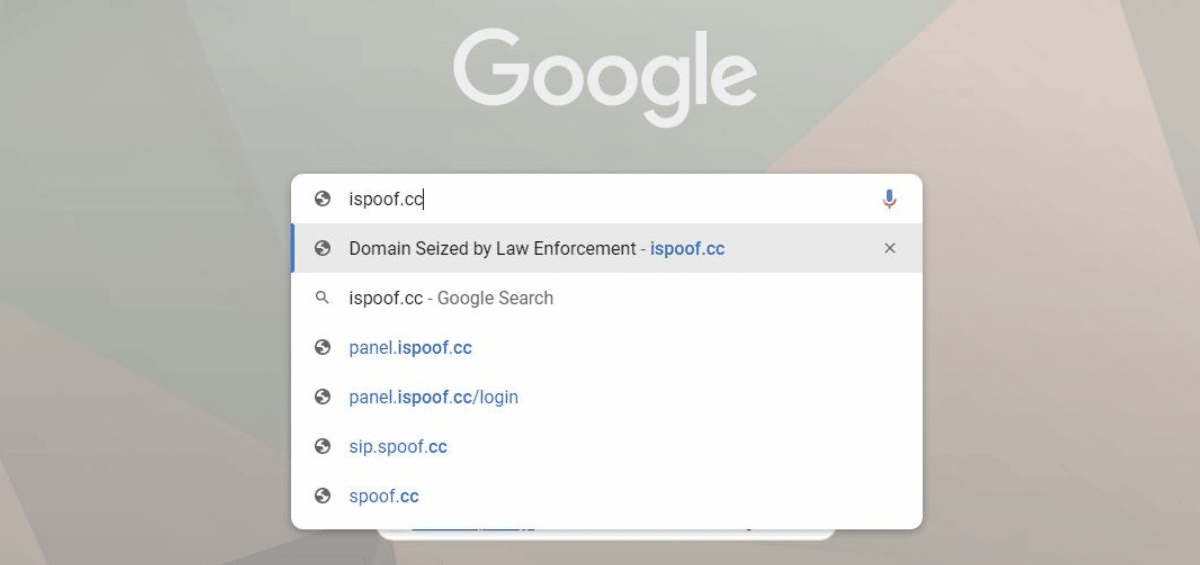

A screenshot taken of the iSpoof website, showing a warning from international law enforcement.

What is number spoofing?

Number spoofing is when scammers change their number or caller ID to hide their identity. They ‘spoof’ or mimic trusted organisations, such as banks, to scam people out of money. Using technology, such as iSpoof, they’re able to target people in sophisticated impersonation scams.

Who used iSpoof?

iSpoof was used by criminals looking to scam people using phone spoofing software. At its peak, iSpoof had 59,000 users. Users paid subscriptions, which ranged from £150 to £5,000 per month, which they paid with Bitcoin.

Which banks did iSpoof scammers impersonate?

Scammers using iSpoof posed as bank staff from a range of UK banks including Barclays, Santander, NatWest and Nationwide. The iSpoof technology allowed them to mimic the banks’ telephone numbers and caller IDs in sophisticated bank scams.

What are bank scams?

Banks scams are a type of impersonation scam whereby scammers impersonate bank staff. They’ll often pretend to be a member of the bank’s fraud team and suggest an account has been comprised. Also referred to as ‘safe account’ scams, the scammer will convince victims to move their money into a ‘safe’ account that they control, ultimately stealing their money.

How many people have been affected by this scam?

The iSpoof scam targeted millions of people from across the world. It’s estimated that 200,000 people were scammed globally with most calls targeting people in the UK and US. In the UK, the police are now contacting 70,000 people they believe were targeted by scammers using iSpoof technology. This news comes only months after the UK was declared the Fraud capital of the world.

How much money has been lost in this scam?

Based on 4,785 victims, who reported the scam to Action Fraud, the average amount lost is £10,000 per person. However, one victim lost £3 million. In total, police believe up to £48 million has been stolen by scammers using this software.

Who was behind iSpoof?

To date, 120 arrests have been made in the UK relating to the iSpoof scam. This includes 103 arrests in London and 17 from outside the capital. Arrests include the alleged site administrator, Teejay Fletcher who was arrested in east London earlier this month and is now facing criminal charges.

Who is Teejay Fletcher?

Teejay Fletcher, of Western Gateway in East London, is alleged to be the site administrator of iSpoof. The thirty-five-year-old is also alleged to be part of an organised crime group, which police say funded his ‘lavish’ lifestyle. He was charged with making or supplying articles for use in fraud, participating in activities of an organised crime group and proceeds of crime matters on the 7th of November. He was subsequently remanded in custody and is due to appear at Southwark crown court on 6th December.

What should I do if I think I’ve been scammed?

You can report a scam to Action Fraud via their online reporting tool. You can also call them direct on 0300 123 2040. However, if the scam is in progress or if you are in danger you should dial 999. If debit cards, credit cards, online banking or cheques are involved, you should also contact your bank or credit card company. You should also reset any passwords that you think may have been compromised.

What should I do if I’ve received a text message from the police about the iSpoof scam?

If you’ve received a text message from the Metropolitan police you will be invited to get in touch. The text message will ask victims to visit the Met’s website to provide more details about their experience. It will not include a clickable link.

How will I know the text message from the police is real?

Text messages will only be sent on Thursday 24th November and Friday 25th November. This is to raise awareness among those believed to be affected. Anyone who receives a text message after this date should disregard it in the event the campaign is hijacked by scammers.

Can I get my money back if I’ve been scammed by someone using iSpoof software?

CEL Solicitors have helped hundreds of people who’ve lost money in bank impersonation scams to get their money back. We never ask for money upfront and work on a no-win, no-fee basis so there is nothing to lose by speaking to one of our professional advisors.

If you’ve suffered at the hands of fraudsters and have lost money, either through an iSpoof scam or otherwise, let the CEL team help you recover your money. Call on 0808 273 0900 or apply online.