As Christmas approaches and the cost-of-living crisis continues, this time of year is financially challenging for many. This also means that scams are on the rise as fraudsters are active now more than ever. Read through the type of scams circulating this holiday season and how to avoid them.

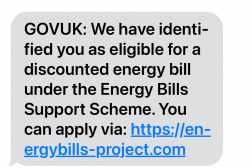

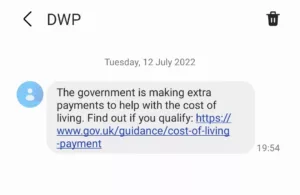

Cost of Living and Energy Bills Scams

Police are warning the public to stay vigilant to cost-of-living text scams. Fraudsters are posing as public sector institutions such as The Department for Work and Pensions (DWP) or the government (GOV.UK) claiming that residents are eligible for cost-of-living grants or discounted energy bills. This type of scam is also known as an impersonation scam.

DWP have issued a warning about the circulation of this scam via Twitter which says “Watch out for scammers targeting people about #CostOfLiving payments. If you’re eligible you do not need to apply for the payment, you do not need to call us, payment to you is automatic, we will never ask for personal details by SMS or email.”

‘Hi Mum’ Text Scam

Parents are being warned about the new ‘Hi mum’ text scams which are being circulated by fraudsters to con people out of their money. The scammers target parents pretending to be their children and eventually ask them to send money to help them in an emergency.

The message will typically start by saying that the sender has lost or damaged their phone and therefore need their ‘parent’ to contact them on another number. The fraudster will then ask you for money to help them out in an emergency, playing on the close relationship you have with the person they’re impersonating.

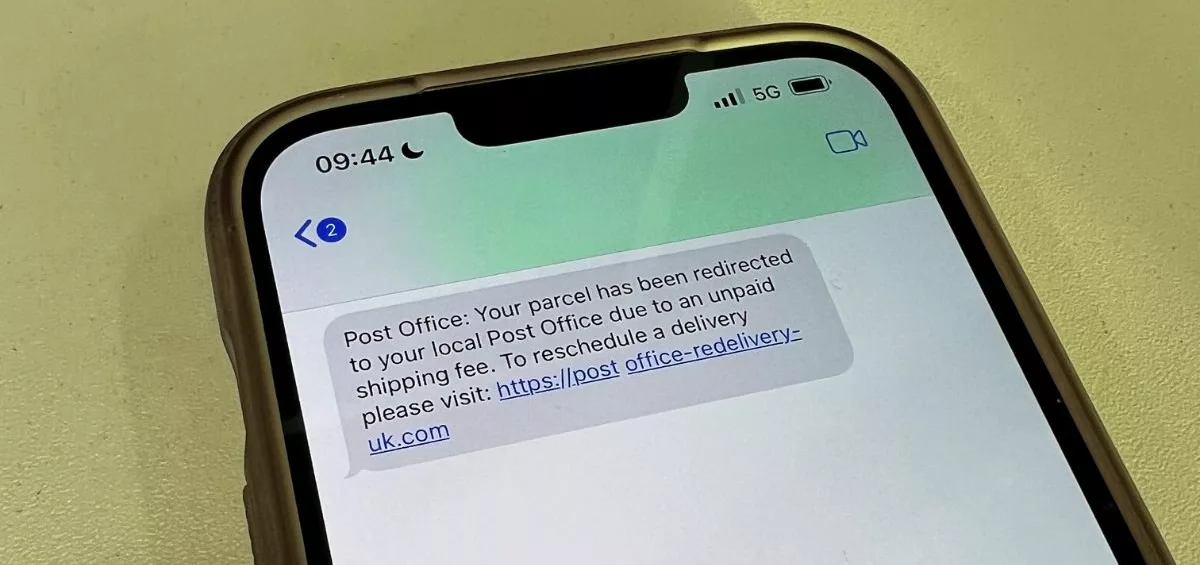

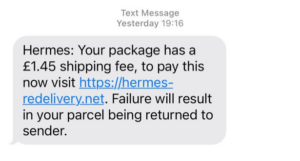

Post and Delivery Scams

At this time of year, many of us will be Christmas shopping online. Fraudsters are taking advantage of this by posing as Royal Mail, Post Office, and other delivery services.

You may receive a text or email which suggests a parcel could not be delivered, therefore a fee must be paid to receive the delivery. There will be a link provided for you to transfer the payment. This type of scam doesn’t always raise alarm bells as scammers will typically ask for a small sum of payment. However, in providing your banking information, you will be susceptible to more fraud in the future.

Read more: Received a text from the Metropolitan Police about iSpoof?

Phone Scams

Scammers may cold call you, pretending to be from a reputable organisation such as your bank or HMRC (HM Revenue & Customs). Older people are more susceptible to this type of scam as they are less likely to be online and more likely to use a landline.

Fraudsters will lure you in by telling you that your card has been cloned or that your account is at risk and will then ask for your card details to rectify the error. These are all things that a genuine bank would never ask of you.

Pension and Investment Scams

Pension and investment opportunities are extremely tempting during these times when many are struggling financially. However, it is vital that you stay vigilant against investment scams as they can have devastating results.

Fraudsters will contact unsuspecting victims out of the blue and start offering high investment returns, loans, or cashback opportunities. A genuine investment company would never call you, so we advise you to be wary of these types of phone calls.

If it seems too good to be true, it probably is. Be sure to read our tips on how to spot an investment scam.

Read more: £30,000 recovered for pensioner who lost life savings to an investment scam

How to Avoid Being Scammed

- Scammers are extremely sophisticated and have effective tactics to lure in their victims. If you receive a suspicious phone call, hang up the phone immediately.

- If you receive any scam emails be sure to flag them as spam so that they do not appear in your inbox again.

- Never click on links in text messages or emails.

- Never provide your personal or banking information online or over the phone.

- Always do your research to ensure that the person or business that you are talking to is legitimate.