CEL Solicitors were successful in returning the full amount lost to an HMRC impersonation scam victim, along with additional interest.

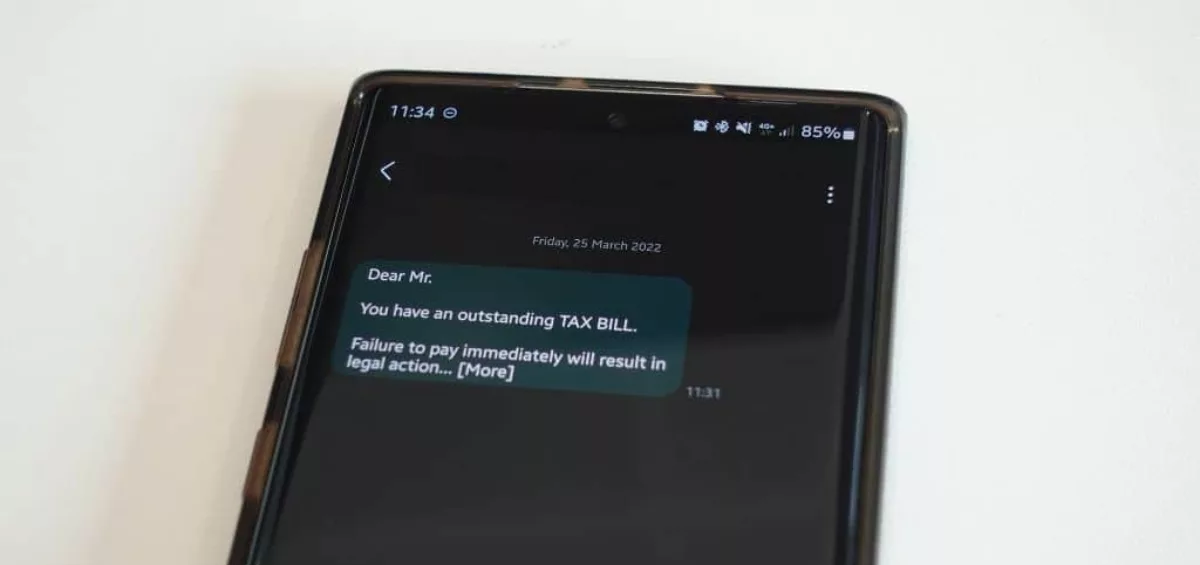

Alexandru, who didn’t want to be named publicly, was targeted by swindlers in an HMRC impersonation scam. He was told that he had an outstanding tax bill which, if he failed to pay, would result in his being summoned to court. Using scare tactics, the scammer said this could result in court fees and fines as high as £90,000. Terrified at the potential repercussions, he paid £2,550 to the fraudster. It was only when he spoke to a family member he realised he had been the victim of a scam.

Talking about the experience, Alexandru said, “I was scammed when someone phoned me pretending to be from HMRC. I requested help from my bank, but I didn’t receive anything. I don’t understand English very well, but I found CEL Solicitors online and contacted them via email with the help of Google translate.”

Unfortunately, it’s not unusual for scammers to target non-native English speakers living in the UK, who may find it more difficult to spot inaccuracies in suspicious messages. Paul Hampson, a director at CEL Solicitors, said: “Scammers pose as trusted organisations to people who might not necessarily be familiar with these organisations’ usual forms of communication. It’s incredibly cruel and sees hard-working people lose thousands of pounds of their hard-earned cash”.

READ: LadBible article on CEL Solicitors returning £150,000 plus interest to romance scam victim

Getting money back from an impersonation scam

With the help of CEL Solicitors’ dedicated scam and fraud team, Alexandru received his money back, plus 8% interest. “I was in contact with CEL Solicitors, waiting and hoping for a miracle to happen, and it did. I got my money back with interest minus CEL Solicitors’ fee, which was so worth it, as I wasn’t able to get anything back myself.”

In addition to HMRC, many scammers also impersonate bank staff, telling customers their account has been compromised and they must move all their money to a ‘safe account’. They may also pose as the police, reporting instances of theft in the branch, again asking customers to move their money quickly.